Welcome to the DC Citizens for Tax Justice!

We are a work in progress. Below you will find some ideas to make Tax Justice in DC a reality. Our goal is to promote a community-wide dialogue on tax and revenue approaches that will decrease our record income inequality and eliminate poverty for all our residents, starting with our children..

David Schwartzman

February 26, 2019

Go to https://youtu.be/RaaHl6lpHo8

And find out HOW WE CAN RECOVER THE FEDERAL INCOME TAX CUT FOR THE WEALTHY FOR LOW-INCOME DC RESIDENTS

Go to the DC Fair Budget Coalition website for its FY2020 Platform at https://fairbudget.org/index.html

< New text box >>

February 1, 2018

Who benefits most from the new federal tax legislation and how to use this to increase our revenue stream for low-income residents, meeting unmet needs ?

Impact of new federal tax legislation on DC taxpayers

In 2019, the top 4% of DC's taxpayers (with incomes above $347,000 will get the biggest tax cut in 2019, 61% of total, while those making over $135,000 will get 78% of the total. Note that the federal tax cut for the same taxpayers is between 1.4 and 3.3 % of their income.

The top 1%, averaging over $3 million/year and will get an average tax cut of $81,240, while the poorest averaging $13,700/year will get a $120 tax cut.

So how much new revenue could be gained for low-income programs in DC’s budget?

In 2019, DC can and should get at very least the equivalent of this tax cut for the wealthy back as revenue by hiking if necessary the DC income tax rate for the wealthy. In 2015, according to IRS the taxable income of DC millionaires (adjusted gross income) was $5.39 billion. For those making $200 thousand and more the total taxable income was $12.8 billion, thus an average 2% hike in their DC income tax payment in 2019 would generate more than $250 million/year.

Sources: ITEP’s up-to-date analysis of the impact of the GOP tax legislation on all the states, plus DC: https://itep.org/finalgop-trumpbill/, Taxable income in 2015: http://www.irs.gov/uac/SOI-Tax-Stats-Historic-Table-2; open DC, MD, VA on the map.

From testimony, January 31, 2018, to WMATA regarding FY 2019 Budget:

(David Schwartzman, Chair, Political Policy and Action Committee, DC Statehood Green Party)

Key selection:

“DC, MD and VA could generate significant additional revenue by simply recovering the remaining federal tax cut for these wealthy residents, leaving them with the same overall tax burden, state and federal, as if no changes occurred in the tax codes.”

“Dedicated funding for WMATA should come from the taxation of regional wealthy residents, commercial property benefitting from WMATA proximity and regional corporate profits

Please note that our WMATA Chair, Jack Evans, certainly has experience with promoting dedicated public funding, e.g., the DC Convention Center and Baseball Stadium.

The WMATA Board should recommend to the governments of its jurisdiction serious consideration of the following progressive approaches to dedicated funding of the WMATA system:

1) Taxation of regional wealthy residents

In 2015, the most recent data available, DC returns with adjusted gross incomes (AGI) of $1 million and above had a taxable income of $5.39 billion, while for the same top income bracket MD had a taxable income of $18.13 billion and VA $24.71 billion (1). For the WMATA region the total tax income of these millionaires was $48.2 billion, now likely even higher. A 1% tax on regional millionaire income alone would generate $482 million!

For residents with AGI $200 thousand and above the total taxable income was $12.8 billion in DC, $61.02 billion in MD and $83.4 billion in VA, giving a total taxable income of $157.2 billion. A 1.1 % surtax on this income would generate $1.8 billion equal to the proposed FY 2019 budget funding from state and local sources. Note that the new federal income tax legislation in 2019 gives these wealthy taxpayers an average tax cut amounting to 1.2 to 3.4 % of their pre-tax income (2), more than a modest 1.1 % surtax that would deliver the total proposed state and local funds amounting to $1.8 billion corresponding to the FY 2019 budget. In addition, DC, MD and VA could generate significant additional revenue by simply recovering the remaining federal tax cut for these wealthy residents, leaving them with the same overall tax burden, state and federal, as if no changes occurred in the tax codes. For example, in 2019 DC could likely gain $300 million in more revenue, badly needed for housing and income support for low-income residents, by just hiking the DC income tax payments from the wealthy by 2%.

Thus , I urge DC, VA and MD to consider raising their state income rate on wealthy residents, especially millionaires, leaving them with the same overall tax liability, a step to making DC, MD and VA’s tax structures more progressive, based on ability to pay. Note that Massachusetts has considered a 4% surtax on millionaire income to be spent on transportation and education (3) Likewise voters in the November 2016 election approved tax hikes on the rich in California and Maine (4).

2) Revenue from taxing commercial property benefiting from WMATA proximity

This case has been eloquently made by Rick Rybeck (5) and his dad, Walter Rybeck (6):

“It is very sad that WMATA is pleading poverty while it is giving away billions of dollars in Metro-created land values. (Metrorail cost about $10 billion to build, but has created more than $10 billion in additional land value around its stations.)” (5)

“A limited number of owners of prime sites near stations reap… Metro-generated land values as windfalls; this fuels land speculation and gentrification… A universal property-tax abatement [reducing the tax applied to privately-created building values while increasing the tax applied to publicly-created land values] would bring about results that exceed the wildest dreams of transit supporters and local political leaders” (6)

3) Revenue from a gross receipts tax on regional corporations

Given that they derive immense benefits from a publicly-funded WMATA, a gross receipts tax on regional corporations should be considered with an Ohio-like provision prohibiting pass-on to prices of its products, and WMATA should strongly urge its jurisdictions to all pass this regional tax.

Endnotes

(1) Source of data: IRS data, http://www.irs.gov/uac/SOI-Tax-Stats-Historic-Table-2; Historic Table 2 State Data Tax Year 2015, open DC, MD, VA on the map).

(2) Source of data: https://itep.org/finalgop-trumpbill/

(3) http://www.bostonmagazine.com/news/blog/2016/10/28/massachusetts-millionaires-2; http://www.wbur.org/news/2016/01/19/economists-push-for-millionaires-tax.

(5) https://ggwash.org/view/43122/wmata-is-up-against-a-budget-deficit-today-it-floated-ideas-for-some-very-big-very-difficult-changes, comment by Rick Rybeck on October 12, 2016 at 12:14pm

‘It is very sad that WMATA is pleading poverty while it is giving away billions of dollars in Metro-created land values. (Metrorail cost about $10 billion to build, but has created more than $10 billion in additional land value around its stations.)

Of course, this is not WMATA's fault. The jurisdictions that comprise the WMATA Compact allow publicly-created land values to become windfalls for private landowners. This is the fuel for land speculation—a parasitic activity that creates sprawl, blight and gentrification. Periodically, speculation creates land booms and busts that bring our economy to its knees.

There is a remedy. Some communities have rectified this situation by reducing the property tax rate on privately-created building values while increasing the tax rate on publicly-created land values. The lower tax on buildings makes them cheaper to construct, improve and maintain. This is good for residents and businesses. Surprisingly, the higher tax on land helps keep land prices more affordable by reducing the profit from land speculation and thereby reducing the speculative demand for land.

Therefore, we should not be cutting transit service for the poor and others who need it. We should be ending publicly-created windfalls for the affluent. (“Put an end to wealthfare!”)

For more info, see “Funding Infrastructure to Rebuild Equitable, Green Prosperity” at http://revitalizationnews.com/article/funding-infrastructure-for-sustainable-equitable-revitalization/’

How Metro can recapture some of the value it creates By Walter Rybeck, November 24, 2017.”

Update (January 20, 2017):

With Trump’s “election” and a Republican Congress, DC Statehood will be put on hold for the next four years and we can expect even less from the federal government from the incoming administration. Hence, we must push the limits of the Home Rule Charter even harder to generate revenue needed for our DC budget to better address the needs of our working class/low-income residents. This approach will empower the struggle for DC Statehood.

Specific initiatives

1) We have a new opportunity to make the DC tax structure more progressive. Given the likely implementation of federal tax cuts for the wealthy, an objective of Trump and Ryan, as unwelcome as they are, they will create even more justification for raising the DC income tax rate on wealthy residents.*

According to a CTJ analysis the top 1%, averaging $1.7 million/per year, would get a tax cut of $88,410 in the Trump plan (Source: http://ctj.org/pdf/trumprevised0926.pdf). In 2014, the most recent data available, DC returns with adjusted gross incomes of $1 million and above had a taxable income of $4.59 billion, while those with AGI of $100,000 and above had a taxable income of $16.3 billion (IRS data, http://www.irs.gov/uac/SOI-Tax-Stats-Historic-Table-2; open DC on the map). For those with greater than $1 million income in DC (AGI), taxpayers in DC, numbering 1,850 in 2014 (the most recent data), this cut would be equivalent to a 3.6% increase in their DC income tax burden, and they would get back about 1/3 of this from their federal deduction offset. This would correspond to millionaires paying 8.8%, compared to working class residents (averaging $40-50,000/year) now paying 10.4% of their income in DC taxes, still regressive but less so than now. A 3.6% hike in the DC income rate for millionaires would generate $165 million extra revenue. A 1% hike for those earning over $100,000 to $1 million would generate another $117 million per year. (Note: These estimates are likely lower limits for Trump’s plan since the CTJ analysis uses average income, not AGI which corresponds to the IRS data.) Plus, this can be implemented without any increase in the overall tax liability (federal plus DC) of wealthy residents (of course they should pay even more)! Even if the federal deduction offset were eliminated we would still come out ahead.

2) DC government should move forward with a DC Public Bank (http://www.dcpublicbanking.org/) , and DC Public Power (https://www.dcpublicpower.org/), thereby generating living wage DC jobs in programs for affordable housing and sustainable economic development.

*Millionaires in DC area now pay between 60 and 70% the rate in their local tax burden that working and middle class residents pay, lower than all but the poorest residents, with working class residents with family incomes of $40 to 50K having the highest burden (“Who Pays?”, ITEP) when the advantage afforded by the federal deduction offset is included.

Next automatic tax cut will benefit low to middle income residents the most:

The District is expecting a boost in revenue, and that means another automatic tax cut for D.C. residents.

“The revenue forecast for 2017 is up by $35.7 million, according to a letter sent by CFO Jeffrey DeWitt to D.C. Mayor Muriel Bowser and D.C. Council Chairman Phil Mendelson. The latest District tax cut is just part of a schedule of pre-arranged cuts tied to recurring revenue. That means District residents will see their standard tax deduction rise from $5,200 to $5,650 for individuals, $6,500 to $7,800 for heads of households and $8,350 to $10,275 for married couples filing jointly. The tax cuts kick in Jan. 1 and apply to the 2017 tax year. In 2014, the council passed a schedule of cuts that would automatically go into effect as revenue climbed, as long as recurring revenue projections showed an increase over the previous year. And while the cost of the new tax cut is substantially less than the new revenue (about $9.3 million) it is because much of the new revenue is considered “non-recurring,” which is the measure for when these automatic tax cuts kick in. For example, taxes on estates can vary dramatically from year to year.”

Here is my analysis of DC's regressive taxes and alternatives that would go a long way to "defeating poverty" in DC if implemented. I also invite all of you to read the most recent Report on State of Human Rights in DC, issued on December 10, 2015; available at http://afsc.org/resource/report-state-human-rights-dc. This report is an assessment of the human rights record of our local and federal governments since DC self-declared itself as a Human Rights City, on December 10, 2008, the first U.S. city to do so. Our District government and elected officials received Fs for Poverty reduction and income equality and welfare of children. Seven years later the grades are D minus and F.

Best wishes,

David Schwartzman, dschwartzman@gmail.com

Tax & Budget Coordinator, Representative to the Fair Budget Coalition

DC Statehood Green Party

Professor Emeritus, Howard University

First, please check out the 2015 tax burdens of families as function of income for DC, MD and VA, all can be downloaded at:

http://www.itep.org/whopays.

DC's tax burdens:

The top 5% income bracket in

DC now pays a lower rate than MD but higher than VA. And all show regressivity above about $50-54K family income when the federal deduction offset is included. DC millionaires

(average family income of $2.8 million) now pay a lower effective DC tax rate (6.4%) than all but the poorest families (bottom 20% income bracket, average family income of $13.6K , paying 5.6%). The

heaviest overall tax burden is 10.3% for families averaging $52.1K a year.

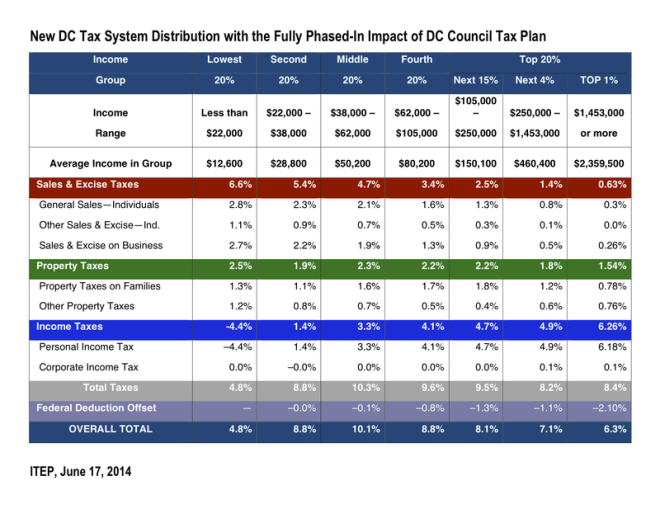

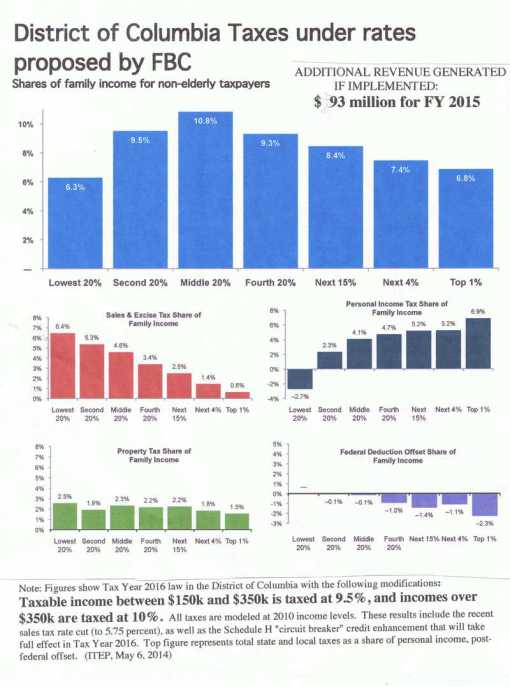

An ITEP Simulation of the Fiscal Year 2015 Support Act of 2014 (B20-750) , passed by the Council (June 24, 2014)

This ITEP simulation is telling us that fully phased-in, B20-750 would leave the top 1% of families, averaging $2.4 million annual income paying an effective rate of 6.3% of this income in DC taxes while families earning an average $50,200 will still pay the highest rate, 10.1%, getting tax relief equal to $351 a year, while those families earning $12,600 (average of the bottom 20%) will get relief equal to $189, leaving many if not most in poverty. This is not a progressive tax plan, recognizing in addition the unwarranted tax cuts for business. See graph below.

<< New text box >>

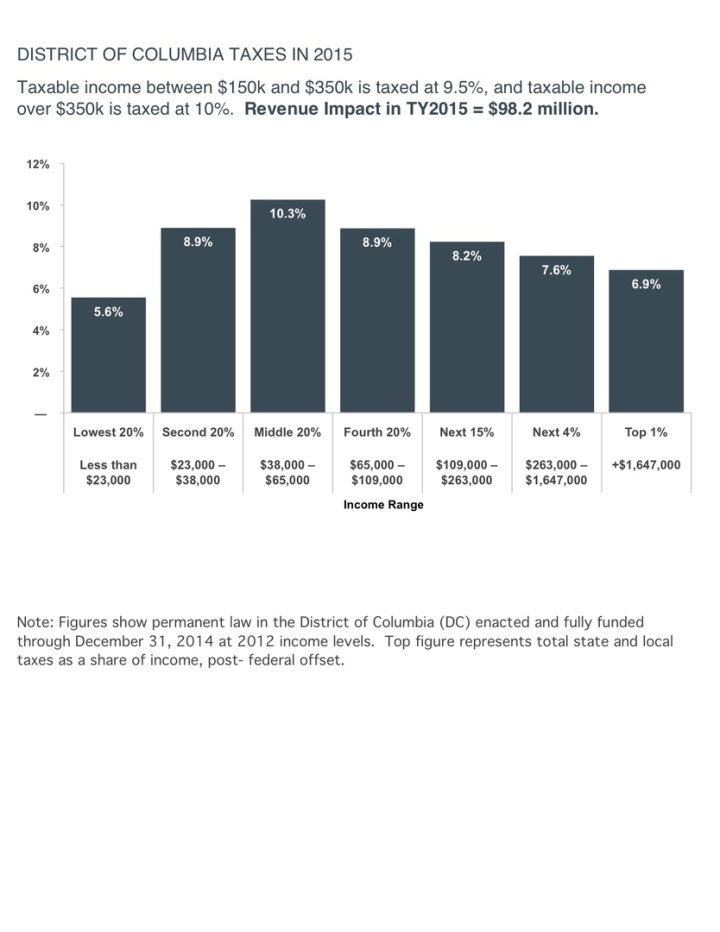

On March 12, 2014, the Fair Budget Coalition lobbied the Council and the Mayor to raise the income tax rate to 9.5% for taxable income between $150,000 and $350,000 and to 10% for taxable income above $350,000. Applying these tax rates in 2015, using the most recent taxable income estimates available, ITEP found these modest hikes in top tax rates would generate $98.2 million in additional revenue, which could fund enhancements to low-income programs and provide tax relief to low income residents. Note that the pattern of regressivity remains, with the top 5% income brackets paying a slightly higher percentage of family income than before these tax hikes are applied (see ITEP-generated simulation below and compare to the 2015 DC Who Pays shown above).

<< New text box >>

<< New

MY CRITIQUE OF THE FINAL RECOMMENDATIONS OF THE TAX REVISION COMMISSION

February 12, 2014

The final recommendations report of the Tax Revision Commission (TRC) is to presented to the Committee of the Whole, DC City Council today by Tony Williams, former Mayor and Chairman of the TRC.

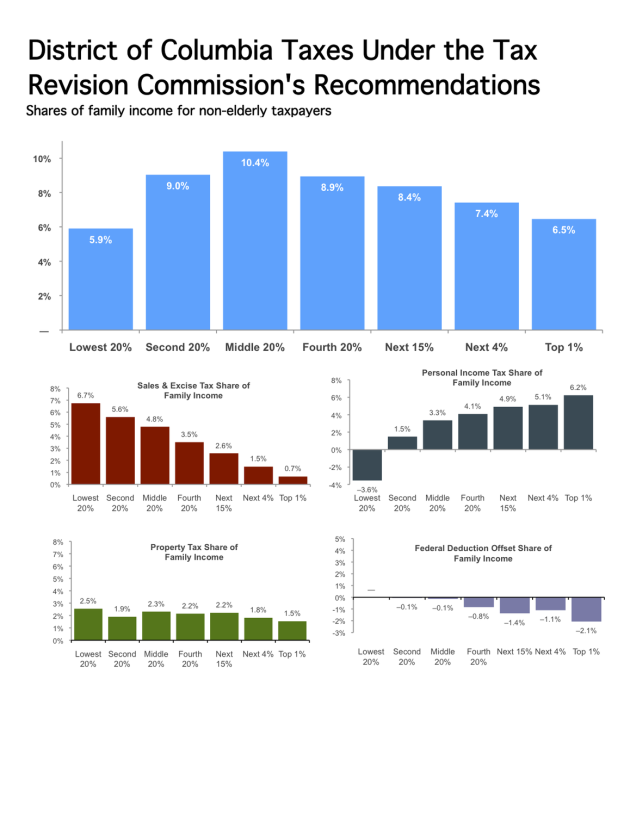

I clap for the final recommendations of the Tax Revision Commission (TRC) weakly with one hand, for the modest tax relief for low-middle income folk. If the City Council implements their recommendations it will make our tax burdens for families mildly less regressive than before but with the same pattern as now, a hump at about $50K, with the top 1% still paying a rate near the bottom 20%; see 3rd Chart below, labelled "DISTRICT OF COLUMBIA TAXES UNDER THE TAX REVISION COMMISSION'S RECOMMENDATIONS".

However, and this is important, implementing the TRC recommendations will result in a cut in anticipated revenue of $38 million for FY 2015 instead of a badly needed increase in revenue, imperative to better fund low-income programs, e.g., TANF income support which is now below the federal poverty level. We cannot assume that potential future surpluses will enhance the low-income budget.

The Institute on Taxation and Economic Policy (ITEP) just released its study on the impact of the TRC final recommendations.

Specifically, with full implementation of the these final recommendations;

The lowest 20% of families, averaging $12,600 annual income will receive approximately $50 benefit/year

The 2nd 20% of families, averaging $28,800 annual income will receive approximately $140 benefit/year

The middle 20% of families, averaging $50,200 annual income will receive approximately $200 benefit/year

While the average of the top 1%, earning $2.36 million annual income will pay 0.3% more in taxes ($7,080/year), this very modest increase will not apply to the top 0.1%, i.e., multimillionaires, who will pay LOWER DC taxes because the provision capping personal exemption in the TRC recommendations (#5g) will be more than cancelled out by the reduction in the marginal rate to 8.75% for the wealthiest taxpayers, down from the present 8.95%. Our wealthiest taxpayers now have an overall DC tax rate lower than all but our poorest residents. An ITEP study indicates that a typical family with a taxable income of $20 million would pay 0.2% ($35, 000) less taxes than under the present structure if the final recommendations of the TRC are implemented. In other words, Tony Williams, Chairman of the TRC and CEO of the Federal City Council (FCC) with support the other two members of the FCC on the TRC, was able to get unanimous support on final recommendations that if implemented by the Council will result in lower tax payments from the most wealthy DC residents. Note that in 2011, the most recent data available, DC returns with adjusted gross incomes of $1 million and above had a taxable income of $3.3 billion. Those returns with adjusted gross incomes of $100K per year and above had a taxable income of $12.4 billion, 67% of the DC total, while making up 22% of all returns (IRS data, http://www.irs.gov/uac/SOI-Tax-Stats---Historic-Table-2).

The Alternative

Here are some measures that our local elected government should adopt for a more just DC tax structure and budget:

1) Add a progressive sales tax credit in the DC income tax structure which would generate even more tax relief for low-middle income folk, since the sales tax is the most regressive DC tax. Support the TRC recommendations to expand the Earned Income Tax Credit for workers without children in the home, and raise the standard deduction and personal exemption to Federal level.

2) The TRC recommends that the top marginal rate be reduced from the present 8.95% to 8.75%. Rather, the top marginal rate should be raised not lowered ! This is the only way the DC income tax on families/individuals will generate more revenue, rather than less, and make a real impact for progressivity. The Fair Budget Coalition is supporting raising the income tax rate to 9.5% for taxable income between $150,000 and $350,000 and to 10% for taxable income above $350,000. A tax hike for the top 5% is very reasonable, recognizing their big boost in taxable income and the fact if such a hike were implemented they will offset a significant fraction of their higher DC income tax liability by including this in itemized deductions in federal income taxes. Using the 2011 IRS data already cited, a 1% hike in their overall tax rate would generate $30 million more revenue for the District’s budget. A 0.5% tax hike for those residents with taxable income above $100,000 would generate $63 million additional revenue.

3) The TRC recommends business tax cuts amounting to $57 million for FY 2015, growing to $65.4 million by FY 2018. Rather there should be no lowering of business tax rates except for small businesses. Ed Lazere from DCFPI and others have proved that business taxes in general are very comparable to surrounding jurisdictions and there is no valid argument to reduce them.

4) Keep the present DC Estate Tax $1 million threshold rather than raising it to the Federal threshold of $5.25 million as the TRC recommends translating into a $13.9 million cut in projected revenue, again for FY 2015.

I continue to argue that incremental revenue from a truly progressive DC tax structure should be targeted to underfunded low-income programs (see my November 12, 2013 testimony on the TRC’s website for a proposal for a steadily progressive and simplified DC tax structure based on a flat percentage of the Federal income tax liability: http://www.dctaxrevisioncommission.org/#!documents/cp9p).

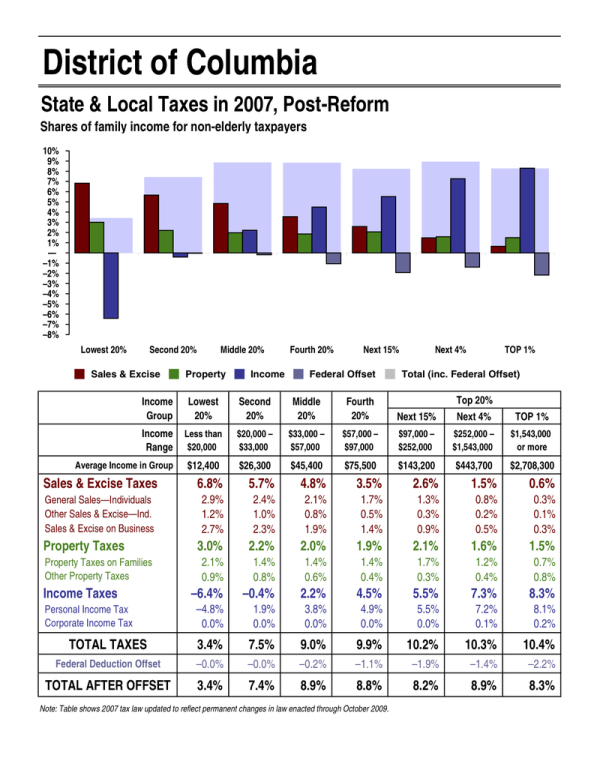

The 4th Chart below shows the impact of this approach.

Go to the TRC website for their final recommendations, report to the Council, testimony and additional information: http://www.dctaxrevisioncommission.org/

The Fair Budget Coalition support for raising the tax rate affecting wealthy residents is very welcome, given the national attention now focused on income inequality, the election of a Mayor in NYC who is committed to raising the top tax rate and of course DC's record income inequality and child poverty level (for more go to the Fair Budget Coalition's website: http://www.fairbudget.org/). Making DC taxes more progressive would be an important step, along with requiring a living wage for all DC workers, towards reducing the income gap and improving the quality of life for all residents, whatever their income.

David Schwartzman

text box >>

BELOW IS A SIMULATION OF STEADILY PROGRESSIVE DC TAXES (ITEP); For details open the tab on this homepage labelled “THERE IS AN ALTERNATIVE: A JUST DC BUDGET AND TAX PLAN”

On March 12, 2014, the Fair Budget Coalition lobbied the Council and the Mayor to raise the income tax rate to 9.5% for taxable income between $150,000 and $350,000 and to 10% for taxable income above $350,000. Applying these tax rates in 2014, using 2010 taxable income estimates, would generate $93 million in additional revenue which could fund enhancements to low-income programs and provide tax relief to low income residents while making our tax structure a bit less regressive (ITEP study).

see the following:

Resource Websites

DC Fair Budget Coalition http://www.fairbudget.org/

DC Fiscal Policy Institute http://www.dcfpi.org/

DC for Democracy http://www.dcfordemocracy.org/

DC Jobs with Justice http://www.dcjwj.org/

DC Public Banking Center http://dcpublicbanking.org/

DC Statehood Green Party

http://dcstatehoodgreen.org/

Citizens for Tax Justice

http://ctj.org/

Empower DC http://empowerdc.org/

Institute on Taxation and Economic Policy

http://itep.org/

ONE DC http://www.onedconline.org/

Email: dschwartzman@gmail.com